Irs Allowable Expenses 2024 – Each year, the IRS adjusts charitable gift rules, tax tables, personal exemptions, standard deductions and other tax provisions. This article highlights the key charitable figures for 2024. . Your financial support must be at least half of the cost of what it takes to make sure your parents are taken care of. The cost includes any money spent on items such as food, shelter, clothing and .

Irs Allowable Expenses 2024

Source : optimataxrelief.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comSection 179 Deduction – Section179.Org

Source : www.section179.orgIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIRS updates Allowable Living Expense standards for 2021 Taxpayer

Source : www.taxpayeradvocate.irs.gov2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief

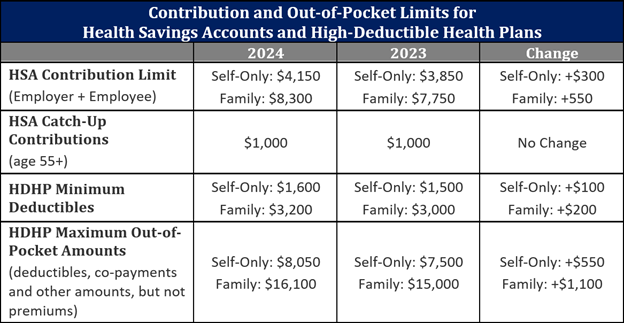

Source : optimataxrelief.comIRS Announces HSA and HDHP Limits for 2024

Source : www.keenan.com2024 IRS Mileage Rates | Optima Tax Relief

Source : optimataxrelief.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comIrs Allowable Expenses 2024 2024 IRS Tax Brackets and Standard Deductions Optima Tax Relief: The use of business aircraft is an allowable expense against a company’s profit, reducing its tax liability. But U.S. tax laws require A bipartisan top-line spending deal for fiscal 2024 would cut . For tax year 2024 (tax returns due April 2025), the standard deduction subtracted from your AGI to arrive at your taxable income. If the total of your allowable expenses is greater than the .

]]>

.png)